Content

Monetary policy, measures employed by governments to influence economic activity, specifically by manipulating the supplies of money and credit and by altering rates of interest. In reality, loan recipients do not deposit all of their loan funds into a bank. If some loan funds are held as currency, then there is a leakage of money out of the banking system. In this case, the money multiplier will still be greater than 1, but it will be less than the inverse of the reserve requirement.

So far our analysis remained confined to the total supply of money at a moment of time. We are equally interested in finding out what the supply of money is over a period of time, say a year, and for this we have to bring into the picture what is called the velocity of circulation of money. These are all instances of a simple and ordinary change or variation in money supply. Supply of money refers to its stock at any point of time, it is because money is a stock variable as against a flow variable (real income).

What is Money Supply?

In America, the Federal Reserve is responsible for the monetary supply. When the Fed limits the money supply via contractionary or «hawkish» monetary policy, interest rates rise and the cost of borrowing goes higher. Reserve money is also called central bank money, monetary base, base money, or high-powered money. It is the base level for the money supply or the high-powered component of the money supply.

- The concept of money supply can be defined as the total quantity of currency that can be included in a nation’s economy.

- Though a causality of the two World Wars and the Great Depression, it still commands respect and even liking in certain circles, leaving the choice in favour of a particular variant under the circumstances prevailing in a country.

- This means that the money the public hold in hand or in the bank is a debt guaranteed by the government (to us).

- The simple connection between monetary policy and monetary aggregates such as M1 and M2 changed in the 1970s as the reserve requirements on deposits started to fall with the emergence of money funds, which require no reserves.

- Inflationary trends after World War II, however, caused governments to adopt measures that reduced inflation by restricting growth in the money supply.

The objective of OMOs is to adjust the level of reserve balances to manipulate the short-term interest rates and that affect other interest rates. Monetary policy is the control of the quantity of money available in an economy and the channels by which new money is supplied. In the United States, the Federal Reserve Bank implements monetary policy through a dual mandate to achieve maximum employment while keeping inflation in check. Not knowing the current money supply places the economy at risk of inflation (too much money) or recession (too little money). You can calculate how much money is created by a deposit using the money multiplier.

Whereas a decrease in money supply will result in increased interest rates, price values with a coupled increase in banks’ reserves. The degree of monetary elasticity depends on the action and power of the central bank. If the money market is well organized and developed the central bank can perform the function of monetary elasticity with efficiency. Thus, a change in needs necessitates a change or variation in money supply and this, in turn, necessitates elasticity in the supply of money. For example, almost 80 per cent of the money supply of the US is made of demand deposits.

Link with inflation

This kind of activity reduces or increases the supply of short term government debt in the hands of banks and the non-bank public, also lowering or raising interest rates. In parallel, it increases or reduces the supply of loanable funds (money) and thereby the ability of private banks to issue new money through issuing debt. As the price levels lower due to increased money supply, the production in business will increase to accommodate people’s increased spending. Thus, the money supply and money demand directly impact the macroeconomics of a nation’s market. M1, also called narrow money, is often synonymous with «money supply» in reports from the financial media.

Vedantu also provides students in grades 1 through 12 with study materials and a range of competitive exams. Notes, important topics and questions, revision notes, and other material are included in the contents. Students must first register on the Vedantu website in order to access all of these tools. The money supply indicates the amount of liquidity that various financial instruments have in an economy.

Open market operations by central banks

If that assumption is valid then changes in M can be used to predict changes in PQ. If not, then a model of V is required in order for the equation of exchange to be useful as a macroeconomics model or as a predictor of prices. In recent years, some academic economists renowned for their work on the implications of rational expectations have argued that open market operations are irrelevant. These include Robert Lucas Jr., Thomas Sargent, Neil Wallace, supply of money refers to Finn E. Kydland, Edward C. Prescott and Scott Freeman. Keynesian economists point to the ineffectiveness of open market operations in 2008 in the United States, when short-term interest rates went as low as they could go in nominal terms, so that no more monetary stimulus could occur. This zero bound problem has been called the liquidity trap or «pushing on a string» (the pusher being the central bank and the string being the real economy).

The Fed can also control the supply of money by its choice of the reserve requirement. Recall that the money multiplier is the reciprocal of the reserve requirement. If the Fed increases the reserve requirement, the money multiplier decreases, implying that deposit creation and the money supply are reduced. If the Fed decreases the reserve requirement, the money multiplier increases, causing both the creation of deposits and the money supply to expand further. The demand deposits are a part of commercial banks and are used as a non-confidential fund. These accounts are considered money when included in the economy of a country.

How Has Monetary Policy Been Used to Curb Inflation In the United States?

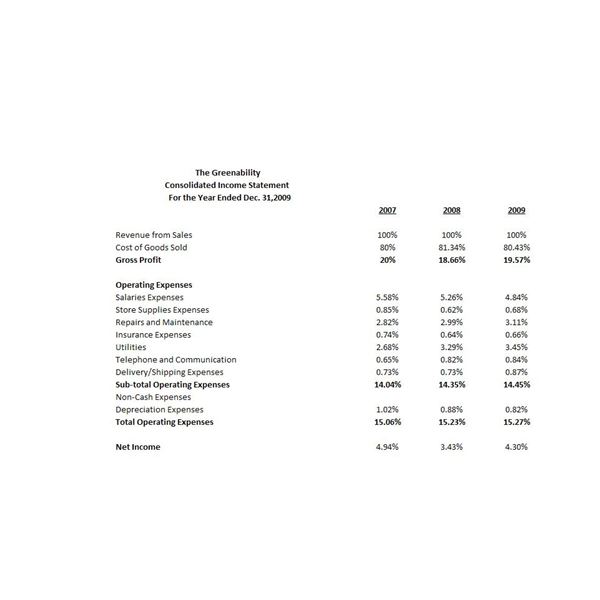

This would lead to a fall in prices, income, and employment and reduce the demand for imports and thus would correct the trade imbalance. It has, therefore, to be observed that various measures of money supply keep on changing from country to country and from time to time within the country. Up to 1968, the RBI published a single measure of money supply (called M and later on M1) defined as currency and demand deposits (dd), held by the public. After 1968 the RBI started publishing a ‘broader’ measure of money supply called aggregate monetary resources (AMR) defined as M or M1 plus the net time deposits of banks held by the public (M3). It is, therefore, clear that interactions among the actions of the public, the banks and the monetary authorities (central banks) determine the money supply. Behaviour of the public depending on currency deposit ratio C/D, that of banks on reserve deposit ratio R/D and that of monetary authorities by the stock of high powered money or the monetary base H.

Savings and fixed deposits, for example, are not considered money since they lack liquidity. The measurement of the money supply is significant since it determines a country’s financial soundness. In India, the RBI has four techniques of measuring money supply, including monetary aggregates and measures of both broad and narrow money. The money supply is the sum total of all of the currency and other liquid assets in a country’s economy on the date measured.

You can think of money supply as any asset in the economy that can be converted into cash to make payments. However, there are different methods of measuring the money supply, and not all the assets are included. Neither commercial nor consumer loans are any longer limited by bank reserves. Between 1995 and 2008, the value of consumer loans has steadily increased out of proportion to bank reserves.

Demonetisation and its effect on Money Supply (M and Reserve Money (Mo)

Such deposits’ working mechanism is similar to that of a checking account where withdrawals from the fund can be made without notice. The inflation of prices of commodities, their demand, and supply change the supply of money. In economics, money supply plays a role in the interest rates and cash flow prevalent throughout the country. Over recent decades, however, that perception of the money supply has changed. In the 1990s, people began to take money out of their low-interest bearing savings accounts and invest it in the booming stock market.

- If the increase in money supply leads to higher demand than the available goods and services can meet, prices can rise, triggering inflation.

- Even though the money supply can be denoted either as M1 or M3, usually when we speak of money supply, we intend M3.

- If the public decided to deposit more money in the bank than usual the bank would end up generating more money.

- M1 includes M0 plus demand deposits, which can be directly used for transactions.

- Although money supply measures are still widely used, they are among a number of economic measures that economists and the Federal Reserve collect, track, and review.

For different calculations, different components are included as ‘money’. Both monetary and fiscal tools were coordinated efforts in a series of government and Federal Reserve programs launched in response to the COVID-19 pandemic. The Federal Reserve releases the latest numbers on M1 and M2 money supplies on a weekly and monthly basis.

Supply of Money

When spending (demand) is abnormally high and supply remains constant, it artificially pushes up the equilibrium price. Monetary supply aggregates are the formal breakdown and measurement of money supply in the economy based on liquidity. M0 is the most liquid category, as it represents all the physical coinage and paper money in circulation. The money supply is commonly defined to be a group of safe assets that households and businesses can use to make payments or to hold as short-term investments. For example, U.S. currency and balances held in checking accounts and savings accounts are included in many measures of the money supply.

Comentarios recientes