Technologies may include cloud-based options such as a hosted accounting file, automated bill paying process and workflow, as well as outsourced payroll processing. The old way of doing accounting is out the door; update to technologies that allow you to stay current and proactive. To be successful, pharmacists need to free up as much Pharmacy accounting time as possible to spend with clients. FreshBooks cloud accounting software helps you get more face time with customers and spend less time tied to a desk. Add a personalized thank-you note and send invoices directly from your account in a matter of moments. FreshBooks offers the accounting tools you need to easily manage your books.

- Going far beyond the standard accounting and tax services, our CPAs specialize in several industry areas and are in tune with the opportunities and challenges faced by each.

- This involves going through each and every balance sheet account and reconciling, which can be quite complex depending on the condition of your books.

- Get started today to send custom invoices, track your expenses and accept online payments.

Running a busy pharmacy means you need to be able to do important work from anywhere. The FreshBooks mobile app lets you work on your business finances on the go, whether you’re running a report on the bus or tracking inventory while out of town for a conference. FreshBooks stays in sync across all your devices, so you always have access to the latest financial data. Upload receipts and respond to clients and vendors directly through the app, from wherever work takes you. When you handle vital medications for members of the community, proper inventory management is key to ensuring you never run out of life-saving medicine.

Save Time

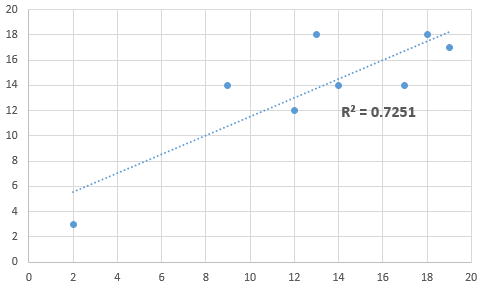

Sales revenue is the total amount in sales that you have generated before any deductions; net sales is sales revenue minus allowances, returns, and discounts. Once you subtract your cost of goods sold from net sales you are left with gross profit. If you take gross profit and subtract operating expenses (payroll, utilities, taxes, etc.), you will be left with net income, also known as net profit. You can also calculate gross and net profit as percentages (also called margins). Having accurate, timely and well-formatted data is important, but to make it useful you need to understand how to put the information to work.

- Technologies may include cloud-based options such as a hosted accounting file, automated bill paying process and workflow, as well as outsourced payroll processing.

- Automatically organize expenses, track time and follow up with customers.

- With high-level encryption and first-class security, your customers don’t have to worry about payment protection.

- FreshBooks offers a transparent, affordable fee structure to remove the guesswork from online payments for pharmacies.

FreshBooks offers seamless integrations to manage payroll and track inventory directly from your account. In order to address the many complex areas of pharmacy accounting, it is vital to have a solid foundation to work with. You have likely heard about inventory control and its importance to your pharmacy. Inventory management and control is vital to the integrity of your financial performance. If your inventory is off $50,000 on your balance sheet then your bottom line is off $50,000 on your profit and loss statement.

Accounting, Taxes, Data Dashboards, Mgt Consulting Bundle

Once your tax returns are reconciled to the books, which can be extremely complex, the next step is to start reconciling the balance sheet. This involves going through each and every balance sheet account and reconciling, which can be quite complex depending on the condition of your books. For example, you may be several years behind in bank reconciliations or you may have several dozen outstanding checks that have not cleared your bank account.

The list of potential issues can go on and on, but making sure each account is reconciled is crucial to updating your accounting foundation and bringing integrity to the system. Staying in compliance with tax laws while making smart choices to minimize your tax burden is essential to keeping your business healthy. Monthly financials delivered timely with well-thought-out layouts to aid analysis. Get in touch to find out how we can help you with your accounting, tax and financial needs.

Tax Services

Our team has decades of experience in owning and operating pharmacies. Using the quality financials and the pharmacy data dashboard to understand your store and to come alongside you as you make critical decisions is our focus. We want to see strong, healthy independent pharmacies that are continuing to make a great impact in our communities, and we would like to partner with you to give you the resources you need. Simply put, we do not want you to feel like you are on an island by yourself – it is always a great feeling to have an experienced team to turn to when you are in need of help. A solid pharmacy accounting foundation begins with making sure your accounting system ties into your tax returns.

Our professional experts also consider abnormal costs here to make it more accurate for you. We are fully dedicated to serving our clients in the best possible way. We formulate a tax strategy throughout the year based on your individual situation. This allows us to create and provide you business tax returns quickly and accurately. Going far beyond the standard accounting and tax services, our CPAs specialize in several industry areas and are in tune with the opportunities and challenges faced by each. The inventory turnover ratio tells you how many times per year you turned over your entire inventory.

Accounting Basics for the Pharmacy Manager

If you get 12, for example, that means you turned over your inventory 12 times in a year. If your inventory turnover ratio is 12, then your days on hand is roughly 30. This is a powerful number for determining how good of a job you and your team are doing in managing inventory. Simplify your payroll system using the FreshBooks Gusto app integration for prompt payments and happy employees. You can set a recurring pay schedule that suits the needs of your small business. Your payroll system will automatically deduct federal, state and local taxes so there are never any errors on employee paychecks.

IRx Accounting Services has specifically designed the structure and content for the pharmacy industry so you as the owner can clearly understand your financial performance. We’re obsessed with giving pharmacy owners exactly what they need in order to manage their books with ease. That’s why our accounting software now includes double-entry accounting – an industry standard feature that helps you keep all of your debits and credits in check.

Pharmacy Management Consulting

It can help you plan for your pharmacy’s future and save you time and money during tax season. You can even invite your accountant to collaborate on your FreshBooks account at no extra cost so they can access reports and analyze your business data. Watch your pharmacy business grow faster than ever with advanced bookkeeping tools from FreshBooks. Daily and monthly aspects of pharmacy accounting and tax preparation and planning can be complex and difficult. Proper pharmacy accounting comes down to making sure your books are current, have integrity, and operate efficiently.

GC questions safety of hemophilia A drug Hemlibra sold by JW Pharmaceutical – KBR

GC questions safety of hemophilia A drug Hemlibra sold by JW Pharmaceutical.

Posted: Tue, 22 Aug 2023 06:07:20 GMT [source]

It also entails streamlining the payable process using technologies that create a timely workflow system and sync directly with the accounting system on a daily basis. We provide pharmacy accounting services and consulting but we also own pharmacies, so our financials include DIR fees, rebates and revenue lines for each payer. As a pharmacist, you look after the health of community members by counselling clients on their medication options. Let FreshBooks look after the health of your business with its all-in-one accounting solutions. Simplify all your bookkeeping needs, from creating professional invoices to tracking employees’ time, recording business expenses and managing payroll.

Selling Your Pharmacy to a Chain vs a Private Buyer

FreshBooks gives important financial insights to help you take your pharmacy business to the next level. In our experience, the most important factors in your success are the ability to obtain financing, manage cash flow and deal effectively with wholesalers. These are areas in which our pharmacy CPAs have a strong record of helping clients like you become more profitable. As a result, we are a leader in serving independent pharmacies throughout the country. Make the billing process as simple as possible for your pharmacy and your clients.

Purchasing is challenging as wholesalers use tiers and rebate structures which often seem to be in place to create complexity and confusion. Payroll is the largest expense after drug costs, but what is the proper payroll level for my type of store and my volumes? As owners, we need trusted information and advice to keep our stores healthy and profitable. These daily processes and technologies allow an experienced pharmacy CPA to make the necessary accounting and tax adjustments at the end of each month.

Automatically record business expenses by linking your business bank account and credit card. Easily record your employees’ work hours with simplified time tracking. We don’t have the luxury of setting our own pricing but instead are controlled by contracts and PBMs. Plans are filled with fees, some of which may reduce payments made on scripts months after the scripts are filled.

Comentarios recientes