If you find yourself a business shopping for a primary-identity money provider, you may be curious for more information on industrial bridging financing. There are several things to consider regarding team connecting funds: they truly are to have business aim only and mostly unregulated.

A professional connecting mortgage try a preliminary-name money safeguarded facing industrial possessions. A professional bridging loan, otherwise bridging financing, facilitate companies availableness easy money to possess providers intentions, if to invest in the fresh office premise, fixing quick-title cashflow issues, otherwise investing the fresh places.

Sure, a professional connecting financing can simply be taken aside to have team objectives. If you would like sign up for a connecting financing to own domestic aim, you can’t get a corporate connecting financing. These kind of fund would be taken out to buy a beneficial brand new industrial property, let balance earnings on your team, or help your company economically when a property chain possess damaged.

A connecting mortgage should be a good idea to possess SMEs who you need an injections out-of resource getting team aim when go out is of essence. To track down a corporate connecting financing once the a little otherwise average providers, the financial institution isn’t too worried about your credit score, so you can however score a connecting loan when you yourself have poor credit. Most of the financial is interested when you look at the is if you could pay-off the mortgage as stated on your log off method.

One which just plunge headfirst into the a bridging financing, it’s a good idea to seem as much as whatsoever the brand new monetary facts online. Connecting fund can be quite costly, so a standard providers loan otherwise a credit card which have an enthusiastic interest-100 % free period is a much better alternative if you prefer a couple of cash.

Can be agencies and international businesses play with connecting money?

Yes, you could potentially. When they enjoys an acceptable log off means, any company usually can discover a lender prepared to lend so you’re able to them. So whether you’re a single, enterprise, commitment or minimal organization, you could get industrial bridging financing.

There are many different things you can use the commercial connecting mortgage to own, here are the popular making use of him or her.

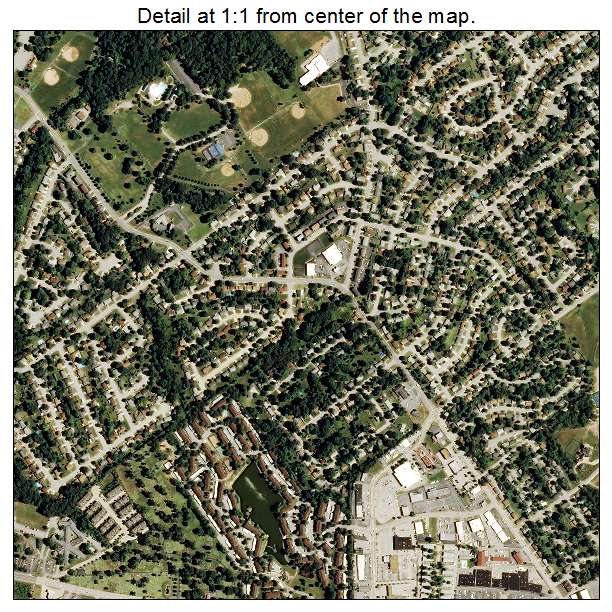

Commerical Property Real estate

As long as the house or residential property you intend to invest in is at the very least 40% to have commercial purposes, you need to use a commercial bridging loan to invest in it. A professional mortgage similar to this can help you circulate fast whenever to order the fresh new installment loans in Memphis IN with bad credit premises otherwise protecting another property generally. You could apply for connecting loans so you’re able to remodel or re-create a home.

BTL Assets

When you’re a landlord and also you plan to purchase a home so you can book sooner, you can make use of your own commercial bridging mortgage included in a good bridge to allow funds contract. This type of agreements is a couple points – the original bridging financing and then a buy-to-let home loan. The best thing is, you could make an application for one another a bridging mortgage and a purchase-to-let home loan within just one to software, which is helpful.

Investment Money Financing

Bridging funds isn’t just used to buy or refurbish property. It helps bring your business an injections of cash to help you make it easier to balance out people brief income points or maybe just make you a lump sum payment to help create your providers. Consider, that it fund is brief-identity (constantly paid back inside 1 year), so you may be greatest finding other funding choices if you desire something stretched-name.

Business Acquisition Mergers

You can use commercial bridging finance having organization acquisitions and you may mergers – so if you’re hoping to pick away a rival or seller, this might possibly be worthy of exploring. If you keeps a secured item to help you contain the loan with, i.e. business premise or belongings, it’s likely you may be accepted to possess a bridging mortgage. Once you’ve had the loan, you can spend the finance as you want to suit your needs.

They might be safe if you know what you are getting on your own on the and you have a well-planned get off technique for paying the mortgage. However,, same as with all of variety of loans, connecting funds has their advantages and disadvantages. Look for more and more the risks lower than.

Exactly what threats are worried which have organization bridging financing and exactly how perform We cover myself?

Because connecting money is actually small-title, you will need to make certain you can be with certainty pay the loan for the total, in addition to desire, from the required period of time. As well, the lender have a tendency to carry out a value analysis; this is exactly to minimize expensive lending.

You’ll want to note that the FCA doesn’t manage bridging funds getting commercial intentions. It indicates you aren’t safe will be anything get wrong, i.age. you receive bad advice otherwise missold the loan.

How you can manage on your own is of the studying this new words and you will conditions of your own mortgage and you may taking out fully financing one it is possible to manage, in case the bundle is to remortgage your residence to repay new lender or sell the property once you’ve remodeled they.

The web based market is enduring having pro bridging collectors simply waiting to make it easier to safer providers bridging funds. Its competitive characteristics setting there are numerous commercial connection loan loan providers for you to choose from.

Going for a lender you to specialises inside form of money form you are in safer give, plus the processes should be much quicker than simply with other old-fashioned lenders.

In the BLD, we works alongside a panel of respected Uk bridging finance lenders – evaluate deals towards the connecting loan list.

Comentarios recientes