Globally Student loan

Sometimes everything you learn about understanding abroad isnt just what your fulfill. Particular college students in reality score admission to study overseas only to rating around stuck. You don’t want to wind up as one of those. But not, while it is almost certainly not possible for you to get fund like the indigenous pupils, you’ll be able to rating a major international education loan instead of an excellent cosigner. The latest Mpower student loan to have around the globe students, such as for example, also have your a loan to study in the us that have zero cosigner.

Taking that loan as a student isn’t really very easy because you may have been informed. Although not, you might find specific personal funds accessible. However these effortless loans enjoys limitations into the amount you might discovered, when you are nevertheless recharging highest appeal. And, many have a tendency to still require that you get good cosigner who’s creditworthy to gain access to finance from the a good rate of interest.

Since your cosigner must be the You or Canadian resident, depending on the nation away from investigation, you may find it difficult to get you to. Yet , a student-based loan cosigner makes it easy on the best way to availableness and you will qualify for money that have a diminished interest.

Therefore, we will proceed to divulge to you the ways you can get student loans due to the fact a global beginner and no consignor. But earliest, why don’t we set down the building blocks into topic. We have to respond to specific inquiries, such, will it be hopeless to own around the world youngsters discover money?

Can Worldwide Students get Loans?

Naturally, International children may financing to fund college throughout the U . s . otherwise Canada. It can be difficult to do it while we hinted more than, however it is not hopeless. Although not, providing a global education loan is determined by the noncitizen updates and having an excellent cosigner.

You will be able to get into any kind of loan ranging from government so you can individual finance in the us while the a major international scholar when the:

- You are an eligible noncitizen: This might be an excellent noncitizen whom implies as the eligible noncitizen to their FAFSA software and produces off their 8 to help you nine finger alien subscription count (ARN). Plus, when this student’s name and ARN try paired towards You.S Service out of Homeland Cover, it must appear clean. So it position enables you to entitled to the fresh Government Services, FAFSA, or other Government supports.

- There is certainly an excellent cosigner so you can indication to you personally: If you’re not an eligible noncitizen along with a student charge, go see a beneficial co-signer who is a U.S. resident otherwise long lasting citizen and has now a good credit score. In the event your cosigner provides a credit rating away from 690 or more, you can access private financing which have competitive rates of interest.

- One individual loan match their you would like: If you fail to supply Federal support and you’ve got zero cosigner that is a great United states of america citizen, you can nonetheless score that loan because a global scholar. You only need to select a lender that have affairs designed for Around the globe children.

How exactly to Look for an international Financing

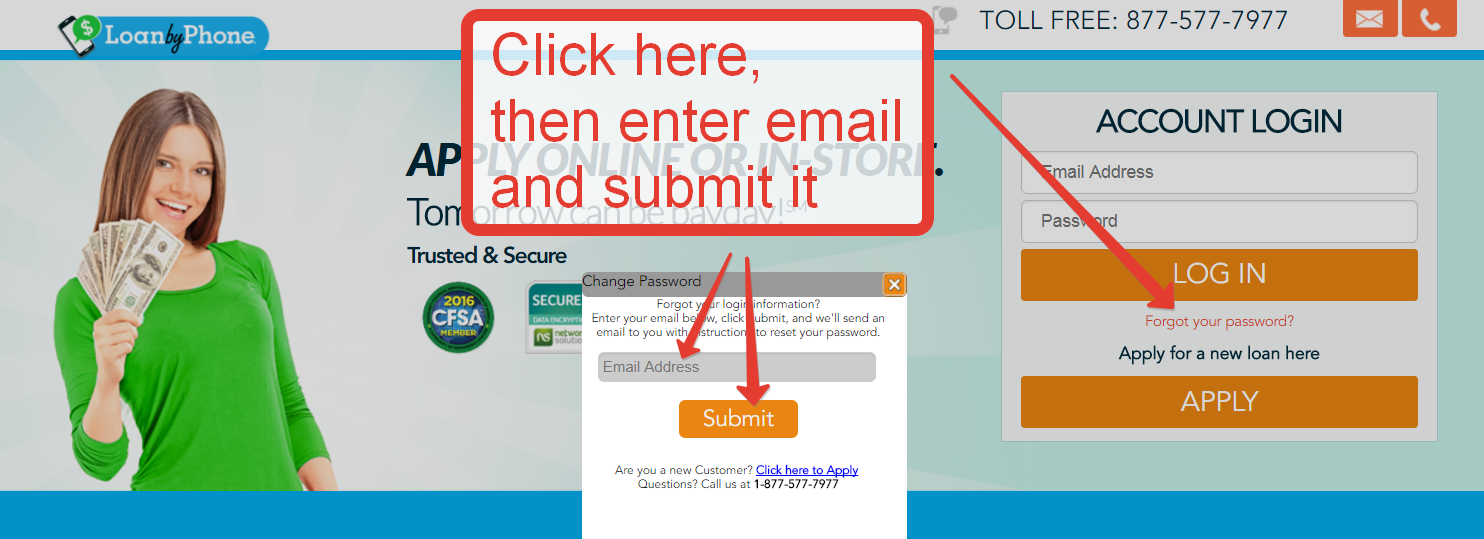

![]()

Thus, now you see you can buy financing once the a global scholar studying in america or any other countries, what is the next step?

The next thing is the option and work out step. You must check the financing criteria you satisfy as a keen around the globe student and decide hence method you’re going to get that loan.

- Evaluate mortgage keeps. Your own grounds of comparison this is the interest. Discover and you may contrast individual global financing provides be eligible for with a decent interest rate. And additionally, reason for the brand new sophistication period to own fee. Usually the lender postpone payments for those who have difficulties investing them? Just how long can they try here delay payments? As well as, find out if discover origination, prepayment otherwise later charge. On top of that, check how without difficulty you could achieve the financial of the cell phone, current email address or live talk for folks who stumble on any problem.

Comentarios recientes